special tax notice empower

1 These documents include additional text from Notice 402f the Special Tax Notice Regarding Plan Payments. Power of attorney conservatorship and guardianship 31.

Pdf Employees Empowerment Through In Service Training

2022 Qualified Default Investment Alternative Notice 31.

. While the Tax Code allows plans to create their. Special Tax Notice Regarding Retirement. Replaced by Empowers Paycheck Contribution Election form.

Convey information needed before deciding how to receive plan benefits. Empower Retirement mobile app or by calling Empower. Rollover instructions and form.

Replaced by Empowers Incoming Rollover Request form. For Payments Not from a Designated Roth Account Effective. However if you receive the payment before age 59 12.

Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan. Special Tax Notice For Payments Not From a Designated Roth Account YOUR ROLLOVER OPTIONS. We continue to add and enhance tools and support to improve taxpayers and tax professionals interactions with the IRS on whichever channel they prefer.

2022 Notice of Automatic Enrollment 28. SPECIAL TAX NOTICE Your Rollover Options. You are receiving this notice because all or a portion of a payment you are receiving from your retirement plan is eligible to be rolled over to an IRA or an employer plan.

This notice modifies the two safe harbor explanations in Notice 2018-74 2018-40 IRB. After receiving this notice you have at least 30 days to consider whether to receive your distribution or have the distribution dir ectly rolled over. How much may I roll over.

Empower Representative Compensation. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. This Special Tax Notice Applies to Distributions from Governmental 457b Plans This notice contains important information you will need before you decide how to receive Plan benefits.

1020 2 of 6 402 f Notice of Special Tax Rules on Distributions for payments not from a designated Roth account The exception for qualified domestic relations orders QDROs does not apply although a special rule applies under which as part of a divorce. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan. If you do not wish to wait until this 30-day notice period ends before your election is processed you may waive the notice period by making an affirmative election indicating whether or not you wish to make a direct rollover.

1820513109 Page 3 of 4 the after-tax contributions in all of your IRAs in order to. Request to Contribute Rollover Funds to the Choice 401k Plan. SPECIAL TAX NOTICE For Payments Not from a Designated Roth Account State Form INSERT FORM NUMBER Indiana Public Retirement System One North Capitol Ave Suite 001 Indianapolis IN 46204 Page 2 of 7 Special Tax Notice.

Empower and Enable All Taxpayers to Meet Their Tax Obligations We will empower taxpayers by making it easier for them to understand and meet their filing reporting and payment obligations. This disclosure describes compensation practices for Empower Retirement LLC Empower employees who interact with individual investors such as investors in retirement plans recordkept by Empower or investors in individual retirement or brokerage accounts offered through Empower or its affiliates. FA 403B Special Tax Notice Form.

The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. If you do not wish to wait until this 30-day notice period ends before your election is processed you may waive the notice period by making an. 529 that may be used to satisfy the requirement under 402f of the Internal Revenue Code Code that certain information be provided to recipients of eligible rollover distributions.

Assignment of 401欀尩 Plan account prohibited 31. Special Tax Notice and tax reporting 31. After all a 401k retirement plan is a key part of your benefits package but the type of 401k plan each.

Receiving this does not mean you are eligible for a distribution or that you have requested a distribution. That means the Notice doesnt have to be provided until the participant elects a distribution. If youre among the millions of Americans who are changing jobs these days part of the Great Resignation as its come to be known youll likely find yourself evaluating 401k offerings.

It explains when and how you can continue to defer federal income tax on your retirement savings when you receive a distribution. You must keep track of the aggregate amount of 1820513109 Page 2 of 4. Special rules that only apply in certain circumstances are described in the Special Rules and Options section.

If you wish to do a rollover you may roll over all or part of the amount eligible for rollover. The safe harbor explanations as. The Special Tax Notice Regarding Plan Payments explains the tax consequences of taking a distribution from your Plan.

Usually it is included along with the distribution form. Any payment from the Plan is eligible for rollover except. This notice is intended to help you decide whether to do such a rollover.

A guide to evaluating an important part of your benefits package. Fee Disclosure Notice 20. Explain how to defer federal income tax on 403 b savings.

This notice is provided to you because all or part of the payment. Tax contributions through either a direct rollover or a 60-day rollover. Special tax rules that could reduce the tax you owe.

Notice of Your Rights Concerning the JPMorgan Chase Common Stock Fund Under the JPMorgan Chase 401k Savings Plan 30. Receiving this notice you have at least 30 days to consider whether or not to have your withdrawal directly rolled over. The Default Investment Notice outlines your rights if you have not chosen funds but are making contributions to the Plan.

You may voluntarily elect to have additional withholding below. Authentication processes may require use of your personal email. SECTION 1 - 402f NOTICE 402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement savings in your retirement plan the Plan and contains important.

Empower Retirement is required to withhold mandatory 20 for federal income taxes on the taxable portion of your benefit distributed to you as a Cash Payment.

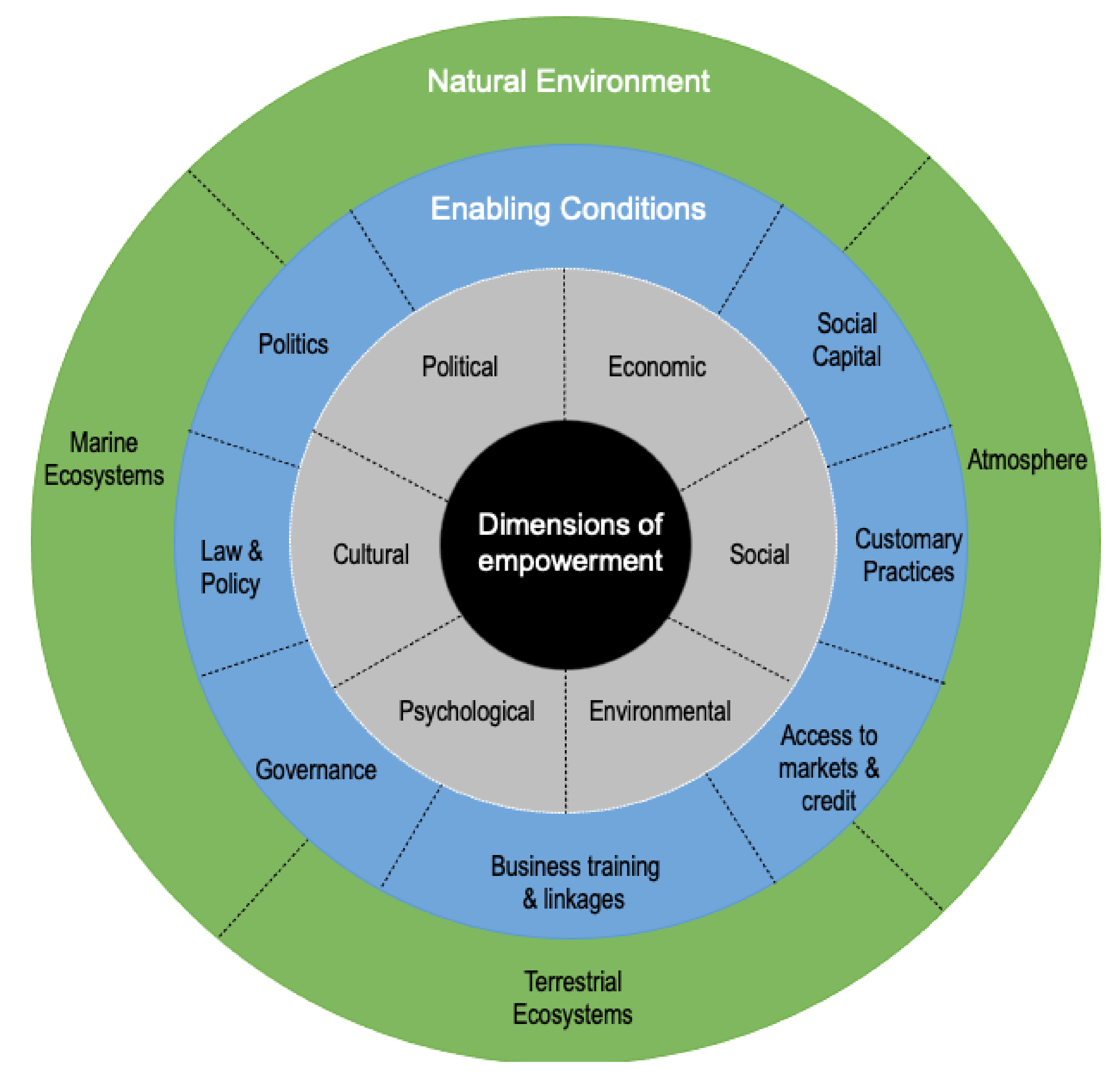

Sustainability Free Full Text Tourism Empowerment And Sustainable Development A New Framework For Analysis Html

Pdf Technology As The Key To Women S Empowerment A Scoping Review

Empower Taxpayers Internal Revenue Service

Empower Taxpayers Internal Revenue Service

Welcome Montgomery County Union Employees

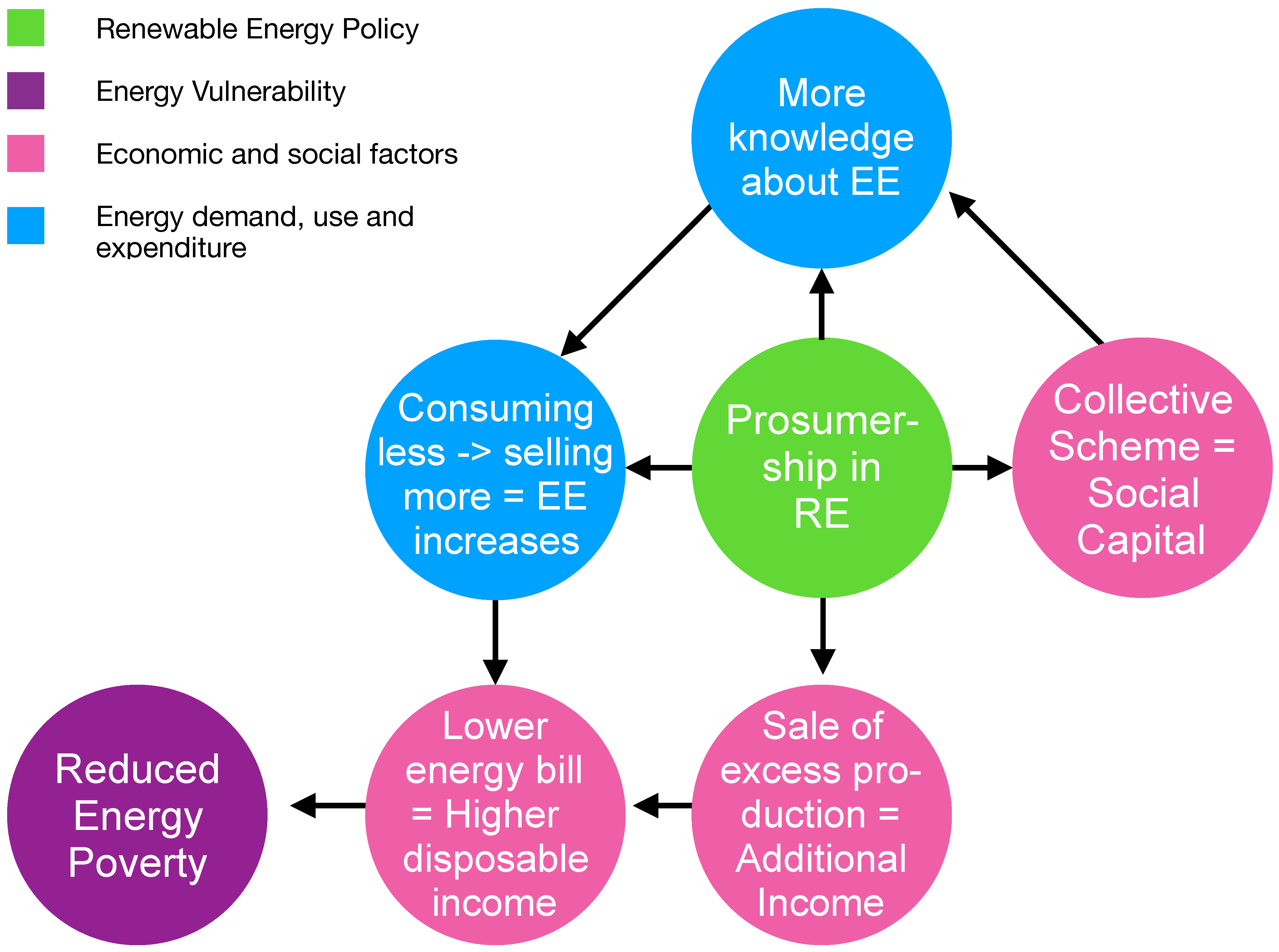

Energies Free Full Text Empowering Vulnerable Consumers To Join Renewable Energy Communities Towards An Inclusive Design Of The Clean Energy Package Html

Amazon Learning Genetic Algorithms With Python Empower The Performance Of Machine Learning And Ai Models With The Capabilities Of A Powerful Search Algorithm English Edition Gridin Ivan 9788194837756 Books

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

Buy Empowered Ordinary People Extraordinary Products Silicon Valley Product Group Book Online At Low Prices In India Empowered Ordinary People Extraordinary Products Silicon Valley Product Group Reviews Ratings Amazon

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

Pdf Behavior Change Or Empowerment On The Ethics Of Health Promotion Goals